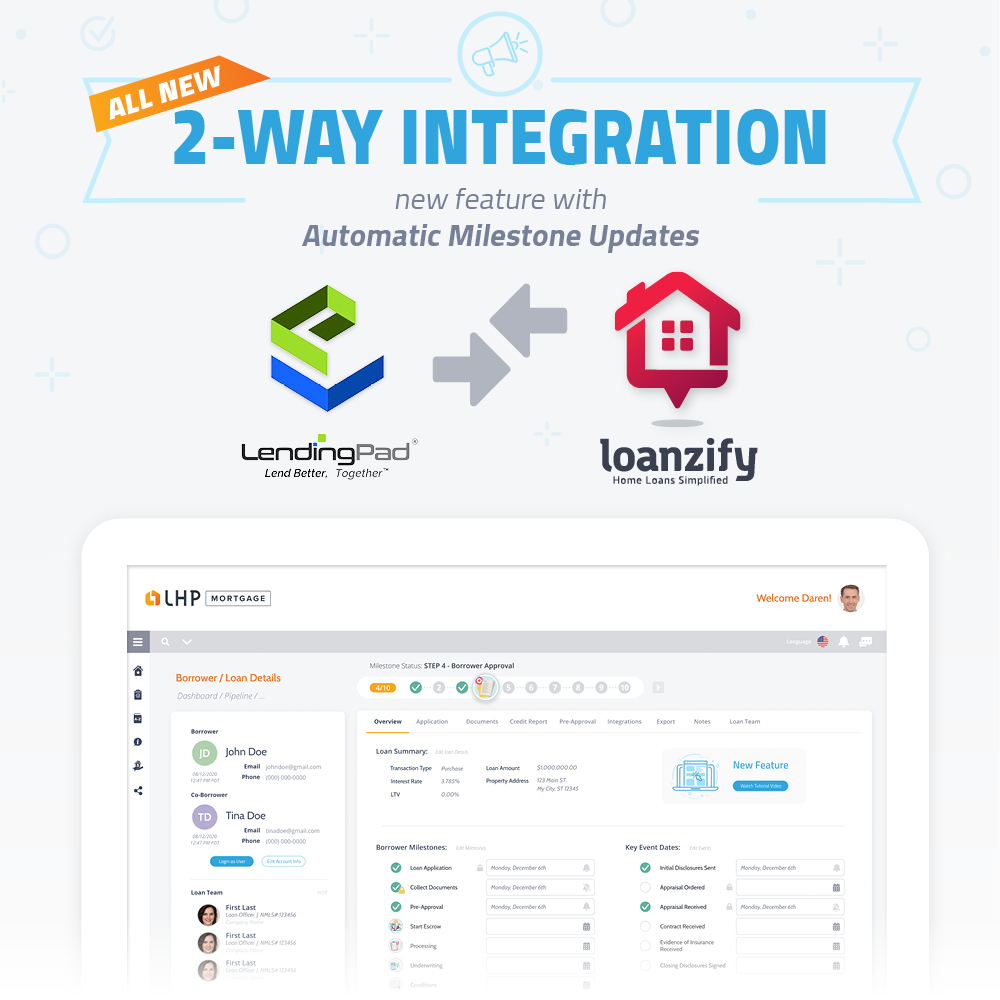

Loanzify Launches 2-Way Integration with LendingPad – “Automatic Milestone Updates”

Santa Ana, CA., Jan 12, 2022 — LenderHomePage today announced new custom “Loan Milestone” capabilities to their mortgage point of sale software, Loanzify. This exceptional update is designed to help originators improve business processes by synthesizing information based on loan type.

Mortgage companies are increasingly turning to technology to help them comb through rising volumes of data sets and sources required for credit decisions. By adding customization capabilities to the intake process, mortgage professionals can collect data relevant to the specific loan product and quickly organize it to hasten fact-driven funding decisions and improve the customer experience.

See the Loanzify and LendingPad 2-way integration in action! Join our webinar this Friday, January 14.

“Digital transformation is an ongoing process, and it’s imperative that we offer products that not only scale with our clients but are also adaptable to their evolving needs and industry demands,” explains Rocky Foroutan, CEO of LenderHomePage. “Seemingly simple changes can have a huge, positive impact on productivity and profitability.”

Tailored Milestones Per Loan Type

Users can identify the workflow they prefer based on the loan type, such as purchase, refinance, VA, etc… Loanzify POS will then populate the required milestones for the consumer. The consumer-facing milestone text and the order can be further edited as the mortgage company sees fit.

Customized Notifications Per Milestone

Users can further personalize the borrower experience by editing the notifications based on the milestone they achieved and the loan product. These notifications also accelerate the loan’s lifecycle and bolster the relationship between borrower and lender, heightening the likelihood that the borrower will complete the application.

LendingPad 2-Way Integration

LendingPad is the first LOS to take advantage of this feature. Loanzify POS milestones have bi-directional communication with LendingPad. This integrated pipeline makes it easier to securely extract data, maintain its integrity, and keep records on both platforms accurately.

About LenderHomePage:

Since 2003, LenderHomePage.com has been the leading provider of a secure and compliant cloud-based digital mortgage platform that powers lender websites, mobile apps, and mortgage POS solutions. Mortgage lenders of all sizes use LenderHomePage.com’s customizable and scalable solutions to enhance borrower experience, streamline the mortgage process, and increase Loan Officer productivity and efficiency.

About Loanzify:

Loanzify POS by LenderHomePage is part of a suite of innovative productivity solutions developed for the modern mortgage professional.