When you work in a highly competitive field like the mortgage industry, your business needs all the advantages it can get!

While there are many tools available to help you grow your business, one of the most valuable is customer relationship management (CRM) software. This innovative technology can leave a positive impact on every part of your day-to-day operations.

Below, our experts outline what a CRM is, what benefits it can provide, and how you can incorporate it into your business model to grow your business, no matter what size your brokerage currently is.

What Is a Mortgage CRM?

A mortgage CRM is a software that can streamline the mortgage process. This technology essentially allows loan officers to perform tasks more efficiently. A CRM can help you to follow up with clients, submit digital documents, advertise your services, and collaborate with team members.

If you work in a team or a larger organization, the best CRM solutions will give you the ability to closely monitor each loan officer’s performance while also improving upon the borrower’s experience.

The best part? CRMs can be integrated with many of the software solutions that your firm might already be using.!

Why Mortgage Brokers Need a Powerful CRM

Mortgage brokers have to balance a ton of moving parts and pieces to successfully close loans on time. Deploying a robust CRM solution can also offer many benefits, allowing you to automate standard processes, present unified branding from one loan officer to the next, and communicate with everyone involved in the transaction in a meaningful way.

When used to its full potential, a CRM platform can also help with:

Improve Borrower Trust

In the mortgage industry, reputation is everything. It’s vital to maintain a positive brand image and build trust with your clients. Remember, they are partnering with you to make one of the biggest purchases of their entire lives.

A mortgage CRM platform will allow you to give your valued clients the experience they deserve. Loan officers will have the tools they need to keep borrowers in the loop at every step of the way. Consistent follow-up and communication will let them know that they can count on you when they have concerns or questions about the mortgage process, which can help to encourage repeat business.

Satisfied customers are more likely to refer a friend to your company or leave you positive reviews on various platforms. When you’ve communicated clearly and effectively throughout the loan process, and when a customer needs mortgage services in the future, there is a good chance that they will seek out your services again.

Reduce Expensive Data Entry Errors

Data entry errors are an unavoidable fact of life. Unfortunately, these mistakes can cost your company money. If a lead’s email address or phone number is entered incorrectly, then your loan officers are going to miss out on a potential sale.

CRM software can eliminate a number of manual data entry practices. You can automate redundant tasks, improving the accuracy of customer data while also avoiding compliance issues. This will free your team up to spend more time doing what they do best — serving clients.

Save Time and Money

Customer relationship management software can also help your business save time and money. Along with automating tedious processes, you can also enjoy access to detailed performance reports.

Use this data to make informed decisions about the direction of your business. The right data can help you to quickly identify and fix problems that may be hindering your productivity.

If your long-term goals include scaling your mortgage business, improving overall efficiency is vital. By using a system to coordinate with buyers, team members, real estate agents, appraisers, and title companies, you can accomplish more with fewer resources.

Enhance Productivity

No two loan processing experiences are exactly alike. Individual borrower responsiveness and external variables like appraisal turnaround times can influence how long it takes to process a mortgage. However, mortgage CRM can help to improve the consistency of your operations overall.

With the best mortgage CRMs on the market, you can take advantage of workflow tools that can expedite loan processing. This can help individual lenders and brokerage teams of all sizes to close more deals and become more productive.

With the right tools in place, your firm will gain a reputation for having short turnaround times, which may prompt more borrowers and real estate agents to partner with your company.

Borrowers can benefit from these workflows, as well. With automated tools that can trigger workflows as documents are turned in, you can reduce delays in loan processing.

Track Loan Officer Performance

Our CRM platform includes user-friendly reporting tools. This software allows you to closely monitor and track the performance of each mortgage broker that works with your firm.

The benefits of analytics are twofold. You can reward top performers by assigning them more leads. In addition, you can work one-on-one with less productive team members to help them become more efficient.

Monitoring and actively improving upon the performance of your mortgage brokers are a great way to improve productivity, which is essential when you plan to grow your business over time.

Analytics are also vital for individual brokers. Single brokers can take advantage of the data provided by a CRM, also learn about weak spots in their workflows, improving their services over time to better serve their clients.

Automate Redundant Processes

Imagine how much more productive you and your teams could be if you could automate redundant tasks, like posting ads on social media or manually entering in information? Fortunately, you can!

Our CRM platform puts the power in your hands. You can automate processes that consume your valuable time. This fully integrated environment will take your lead conversion capabilities to the next level.

Automating these processes will benefit your business in other ways as well. When employees don’t have to perform as many tasks manually, they can take on more dynamic responsibilities that allow them to show off their talents.

Individual brokers and small teams rarely have the time or resources to hire in-house marketing staff, either. With the right CRM, you can take advantage of high-quality pre-made content that’s branded to your firm and posted automatically on a schedule so that you can continue to attract clients long after the end of the business day.

Streamline the Borrower Experience

A great CRM platform also includes a digital loan platform. This helpful tool allows you to streamline the borrower experience. Clients can submit forms and documents online, getting an automatic notification anytime they request new documentation or move forward in the lending process.

Teams can benefit from this powerful platform as well. Take a file through underwriting with ease when team members can seamlessly collaborate with one another, review documents, send push notifications to borrowers, and more.

What Tools Are Included in a Mortgage CRM?

Every mortgage company has unique needs. The best CRM solutions can support lenders of any size, including multi-office enterprises, mid-sized teams of mortgage brokers, and individual loan officers.

Advantages of a Mortgage CRM for Individual Brokers

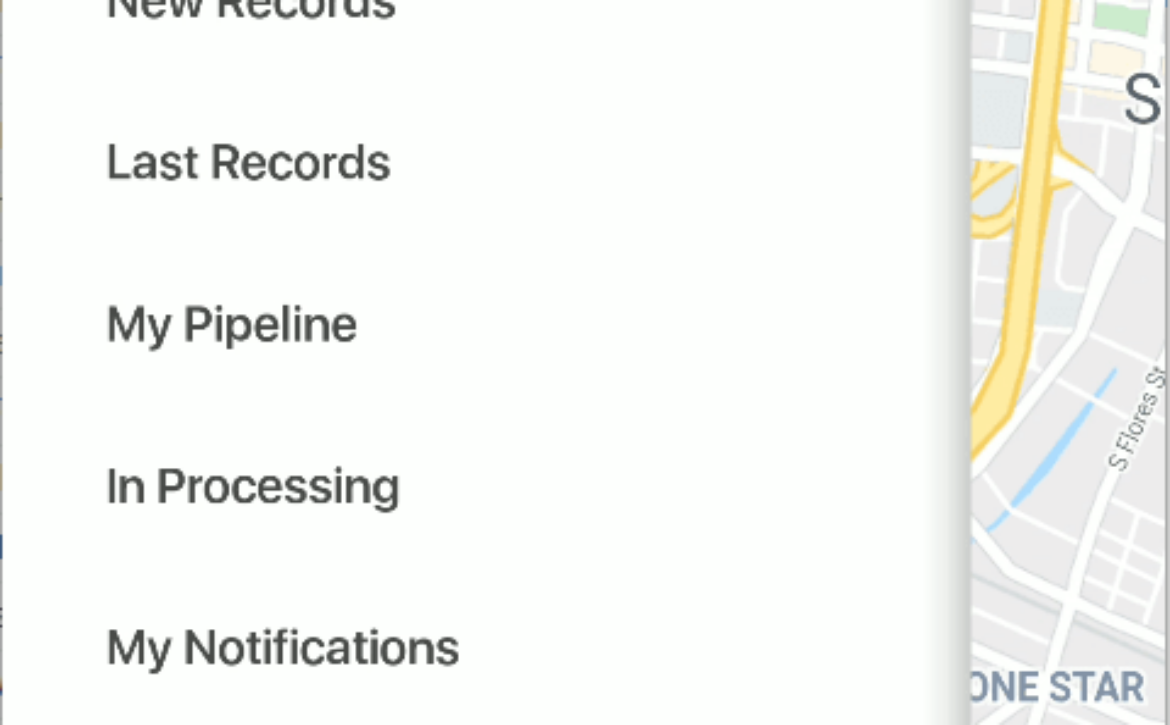

A CRM platform for individuals provides independent loan officers with the tools and resources they need to keep pace with larger lenders. Top software should include a mortgage lead marketing platform, digital loan tools, and access to a massive mortgage content database.

CRM solutions for individuals make staying in touch with borrowers easier than ever before. Stay on top of transactions for current clients while also remaining in contact with previous customers.

Set-it-and-forget-it functions may include pre-configured campaigns that will provide alerts for meaningful dates like birthdays and closing date anniversaries and notify you when a buyer might benefit from a note about refinancing their loan to take advantage of new rates.

These tools are usually available for a fixed monthly fee. If you decide to expand your services in the future or partner with another mortgage broker, you’ll want to work with a provider that can easily upgrade your account to a team solution at any time.

Advantages of Mortgage CRMs for Teams

A CRM for teams should expand on the features included in the individual package. These solutions should also be scalable based on the size of your office, accommodating as few as two loan officers or as many as 50!

Perhaps the most beneficial tool you’ll want to find is a comprehensive team collaboration platform. This allows your loan officers to stay connected with real estate agents, assistants, processors, and other partners.

With top tools, every team member can work on the same files, share important notes, and access status updates on pending loans.

A team-oriented solution should also offer an innovative lead distribution platform. You can receive and distribute leads automatically. This kind of platform allows you to track and analyze the performance of each loan officer. You can use this data to reward your best brokers and identify ways that you can improve the borrower experience as an organization.

Powerful CRM Solutions for Enterprises

Managing a mortgage enterprise that includes multiple offices and dozens of loan officers is an incredibly complex undertaking. That is why you need a customer relationship management platform that is designed to keep up.

An Enterprise CRM includes the functionalities outlined in the “Individual” and “Team” sections, as well as several unique capabilities.

Enterprise solutions should give you total control of every aspect of your business. They can also provide you with access to multi-level analytics, which can yield insight into team performance.

You can use this information to deepen customer satisfaction, improve brand awareness, and revolutionize the way you process mortgages.

BNTouch: The Premier Mortgage CRM Platform

Whether you are an independent loan officer, a mortgage broker supervising an entire team, or the leader of a multi-office enterprise, BNTouch has a solution for you. Our scalable CRM platform gives you the tools you need to succeed.

To learn more, contact our staff today. We can provide you with additional pricing details or set you up with a free demo.

The post Lenders of All Sizes: How a Great Mortgage CRM Can Help Your Business appeared first on .