Leaders of banks, credit unions, and other financial services organizations have been on a roller coaster over the last five years. Signs suggest some of that disarray will settle in 2025 as interest rates drop and inflationary pressures ease. Yet, according to Deloitte, the top challenge for financial institutions in 2025 will be adapting to what it calls a “low-growth, low-rate” environment, where a mix of slower consumer spending, higher unemployment, and lingering geopolitical and regulatory uncertainties keep us teetering on the edge of a recession that’s been threatening the last three years.

But leaders need to resist rash reactions to these anxieties because, as we’ve said before, financial institutions can’t cut their way to growth. Those that pull back too strongly on investing in innovation will quickly damage customer experience and hurt long-term loyalty—and won’t be ready to capture opportunities when conditions do begin to turn around.

Success in 2025 depends on thinking beyond the next quarter. Financial institutions need to build enterprise-level strategies that position their businesses for long-term success.

So, what does that long-term, enterprise-level strategy look like?

How we got here: Boom times shifted the focus from relationships to transactions

Think back to the five years leading up to the start of the pandemic: Things were good. Many financial institutions saw such high business volume that they were just trying to get the transactions done. Strategies became ad hoc and short-term—making quick hires to throw people at the problem and/or piling on point-solution products that promise to solve specific issues.

We can look past the pandemic period of 2020-2021 as a (hopefully) once-in-a-century anomaly. But when rates started increasing in 2022 and the economy slowed down, the transactional focus of many financial institutions led to some knee-jerk reactions: cutting costs, cutting staff, and cutting vendor expenses.

The economy proved surprisingly resilient, holding off the recession that was forecast in 2022 and 2023. Some financial institutions saw volume bounce back—forcing them to quickly add staff and develop ad hoc strategies to keep up.

Today, we’re back to worrying about a slowdown. We’re seeing major banks worldwide announce significant job cuts, with Citigroup, Wells Fargo, and Goldman Sachs all making huge layoffs.

What smart financial institutions do differently: invest in a long-term growth strategy

The most successful financial institutions over the last several years (and, more broadly, the most successful businesses across all sectors) share a common strategy: They didn’t enact massive cuts. In fact, many invested more, doubling down on building the best tech stack and developing extremely efficient processes.

There are two outcomes of this double-down strategy:

- Leading financial institutions remain leaders in delivering best-in-class customer experience. After all, with revenue already down, no business wants to lose customers. And with FinTech disruptors constantly innovating, if you’re not keeping up, you’re falling behind.

- Leading financial institutions are able to build the scalable infrastructure they need to capture opportunities at speed. So, when the economy turns back around, they’ll be instantly ready to handle the increased volume—without having to add incremental costs by throwing staff at the problem.

Case study: Lake Michigan Credit Union maintains mortgage purchase volume through high-rate years

A great example of this is Lake Michigan Credit Union: As rates rose over the last two and a half years, this credit union’s mortgage volumes stayed far higher than most.

Why? Because when the refi boom occurred back in 2020-2021, Lake Michigan CU stayed the course on its overall strategy of balancing purchase and refi business. They didn’t over-index on refi, so they were able to stay consistent through the down economy.

Moreover, they continued to evolve and advance their tech stack. Bet on them to be at the front of the line to capture volume when it returns.

Learn more in our case study with Lake Michigan Credit Union >

Three pillars of a long-term strategy

How can financial institution leaders take a long view on positioning themselves for success when the economy turns around?

Here are three key pillars of a long-term strategy:

1. Building an enterprise-wide data strategy

Financial institutions generally have three main pools of data: accounting, marketing, and IT. These data pools are typically not well integrated—and short-term strategies tend to only reinforce those data silos.

To effectively leverage data to interact and prospect, financial institutions need to develop an enterprise-wide data strategy that integrates all their data to unlock new insights and drive better outcomes. The benefits of consolidated data management will almost inevitably come in the form of better marketing ROI, improved customer interactions, and even increased profitability.

Today, we’re seeing more and more financial institutions hiring consultants to help them design this kind of overarching data strategy—delineating how data will be aggregated and integrated. A comprehensive data strategy will also set data governance policies to ensure data is cleaned and protected—and define how compliance teams handle data to ensure sensitive data is locked down properly.

2. Reducing friction points in CX (and EX)

Leading financial institutions are doubling down on tech investments, particularly around reducing friction points in their customer experiences (CX) and employee experiences (EX). Building a tech stack that works seamlessly together often means consolidation. Following an analysis, the financial institution will work to remove duplicative or point products and replace them with widely adopted, comprehensive platforms.

For customers, that means delivering omnichannel, predictive, and hyper-personalized experiences. For employees, it means connecting data silos and making it easy for them to get the information and workflows they need to be productive.

3. Enhancing internal training & onboarding

The short-term, transactional approach treats staff as fungible resources: When volume goes down, financial institutions lay off employees. Because when volume comes back, it seems easy to just hire additional people.

This approach overlooks the reality that the value of employees largely depends on their experience.

Moreover, training is the only shortcut to experience. A smart, long-term strategy focuses on maximizing the value of a financial institution’s human resources. Building strong internal processes and training programs will ensure employees are both able to execute well within your environment and enable you to more efficiently and effectively onboard new staff if you need to add people to accommodate volume.

Double down on relationships & build long-term loyalty

Right now, we’re seeing a sharp divide in how financial institutions are reacting to slowing growth amid other persistent economic anxieties and uncertainties.

It feels like half of financial institution leaders are waking up every day scared—and letting those emotions guide an overall strategy toward a much shorter-term focus. Of course, it’s human nature to get concerned when revenues drop. The natural temptation is to slash costs and take a month-to-month or quarter-by-quarter view on survival. But it’s never smart to let emotions guide enterprise strategy.

The other half are doubling down—continuing to focus on improving CX and deepening loyalty. They’re building scalable business models that will let them pounce on opportunities, without the chaos and costs of having to scramble to add people and build ad hoc processes when the moment of opportunity hits.

Total Expert General Manager of Banking James White says, “It isn’t about cutting costs. It’s about giving your organization the ability to generate more revenue for every dollar spent.”

Cutting back and focusing on survival is a risky proposition. By doubling down on what you need to win loyalty today and capture volume in the future, your financial institution will be able to differentiate from transaction-focused financial institutions—and win the long game by earning customers for life.

—

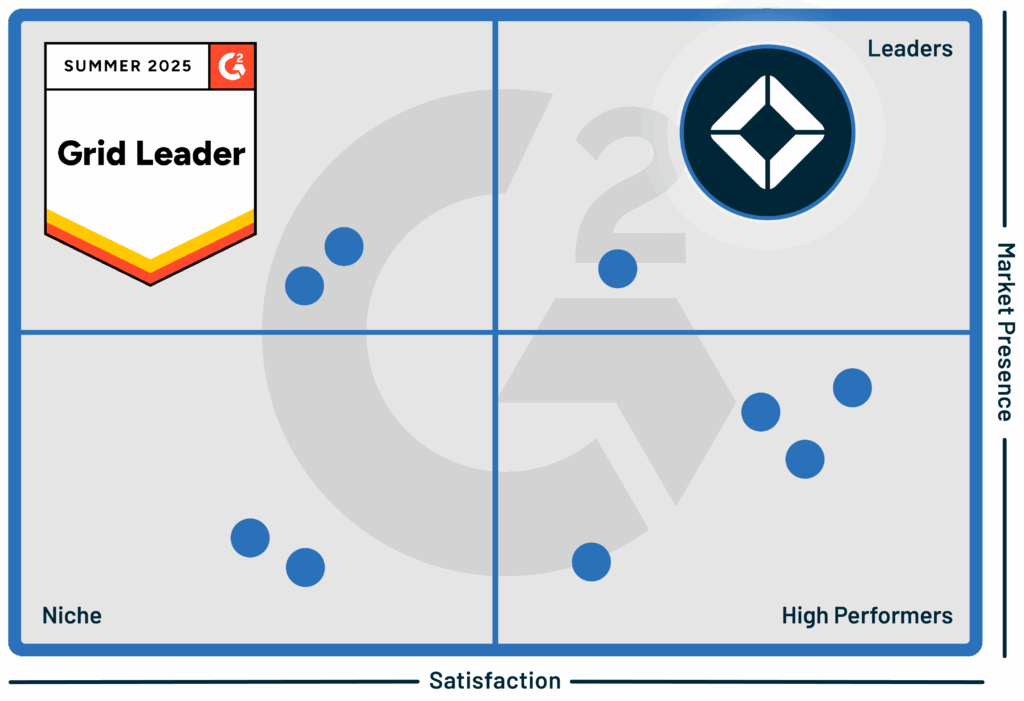

Building deeper customer relationships starts by truly understanding your customers’ financial needs and goals. Learn how Total Expert Customer Intelligence can give you the insights you need to engage your customers in more meaningful conversations.

The post Prioritizing Lifetime Loyalty: Thinking Beyond the Next Quarter appeared first on Total Expert.