Operational leverage: The opportunity lenders need to address

The post Operational leverage: The opportunity lenders need to address appeared first on Blend.

The post Unpacking the value of the Consumer Banking Suite appeared first on Blend.

Millennials are now a significant percentage of home buyers. But they have a different approach to mortgage shopping than previous generations. Mortgage businesses can adapt to these changes to connect with younger borrowers.

Here are four ways millennials have changed the process of mortgage shopping.

Younger mortgage shoppers are looking for a digital-first mortgage shopping experience. Millennials are looking at your website for resources and answers to their questions.

The most successful mortgage practices offer seamless digital tools. A customer portal can make it easy to complete the steps from home. Users can upload documents, receive feedback, and more. E-signature options can likewise reduce the need for in-person appointments.

Millennials also look to these digital platforms for better visibility. A digital platform can provide feedback so borrowers can track their progress.

Millennials worry that homeownership is beyond their financial reach. As a result, they’re looking for any advantage they can find. Millennials can use the internet to compare rates from different lenders. They may even know your rates before you ever meet them.

For that matter, many online publications put together snapshots of different mortgage companies. This allows users to compare rates and terms from major lenders.

To better connect with millennials, it’s important to offer transparent pricing. It also helps to highlight the unique value of your lending practice. Doing so can entice millennials to make a commitment.

For most millennials, this is the first time they’ve purchased a house. The mortgage process can seem like unfamiliar territory. In the past, these young adults have looked to their parents for guidance and support. But many millennials live at a considerable distance from their families.

This may leave them looking elsewhere for direct guidance. How can your mortgage practice fill this gap? By offering educational tools and other resources. These resources should aim to educate millennials on how the process works. That way, they’ll know what to expect and how to meet the lending requirements.

Additionally, you can establish regular communication with your clients. The right mortgage CRM can send automated messages at regular intervals. This gives millennial borrowers clear, consistent feedback at every step of their journey.

Today’s borrowers want to partner with companies that share their values. Does your mortgage company pursue sustainable initiatives? Do you emphasize diversity and inclusion among your team members? Do you give back to the community?

Millennials are more inclined to commit to companies with values that mirror their own. Highlighting your commitment to social responsibility can help you connect with millennial customers.

Are you ready to address these concerns? If so, a mortgage CRM system can help you market your business. It can also provide a digital experience to meet the needs of millennial borrowers.

Discover how the BNTouch platform can transform your business.

The post 4 Ways Millennials Have Changed the Process of Mortgage Shopping appeared first on .

Do you need aesthetic username ideas and aren’t sure about what to choose? Here in this article, we have listed aesthetic username ideas that you can use. A cool username surely creates a good impression on social media. Maybe your real name is already taken on the platforms. Therefore, using a phrase as your username might be simpler. Also, it is possible to stay hidden by typing these kinds of names. Sometimes it is better not to use our real names so that we can be anonymous. In this way, we can hide from the people that we don’t want to share our posts with.

Get Inspired

You can take the aesthetic username ideas that we have created as suggestions and get inspired. These are the best for Twitter, Instagram, Tumblr, TikTok, games, etc. There are many different options to choose from. Choose the right one that will help people get to know you better. So, be creative and create something memorable and shows off who you are as a person!

For further suggestions, read our article Username Ideas.

Also, check out How to Create the Perfect Instagram Bio to have insights about creating your bio!

Aesthetic Username Ideas For Boys

Aesthetic Username Ideas For Girls

Aesthetic Usernames Ideas

Soft Aesthetic Username Ideas

The post Aesthetic Username Ideas appeared first on Heropost.

On social media platforms, everyone needs unique username ideas that define them. Whether it is a business or a personal account, your username helps people recognize you and create your first impression on viewers. It is the first thing that represents you at first sight. So, identifying your username with yourself is the top priority while choosing it because you convey your identity through its meaning. A representative username is what enables people to find you on social media, and a unique and aesthetic one will also help you stand out amongst others.

Choosing your username can be confusing because of many options you can pick when you want it to sound creative and original. You know your username should be catchy to others’ eyes in order to grab their attention. The problem is sometimes it is hard to find your desired username available because it is probably already taken. Therefore, we will give you simple and effective username ideas about how to pick yours.

Tips to Choose the Right Username Ideas

Before thinking about what is the username you need, keep in mind that your username should be:

When you pay attention to these tips, you’ll know how you should form the right username for your account.

The Best Username Ideas

Your username is extremely important as it is what represents you and has a long-term impression on viewers. If you have already decided what keywords you can use, different types of combinations will be useful to keep your desired username even if it is not available. Username ideas are below to help you!

Let’s get some username ideas about how you can form the one that suits you!

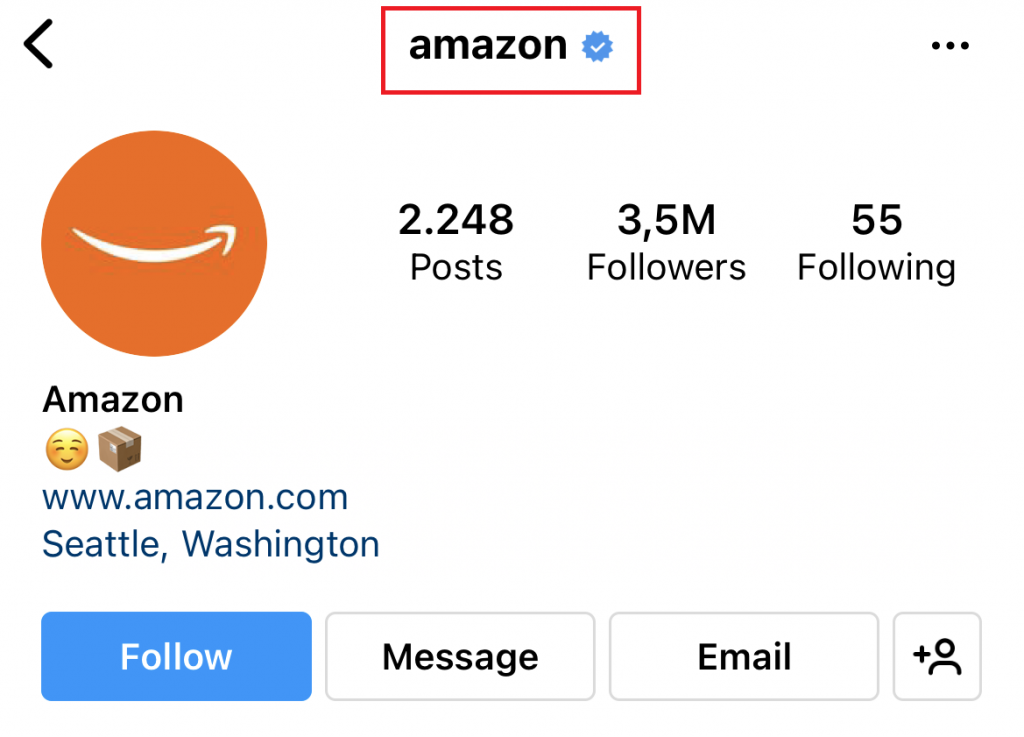

1. Use Your Name

If your name is available, use it directly on your username. (e.g., brand name)

@Amazon

@Toyota

@ReddBull

@aliciakeys

@charlieputh

@ciara

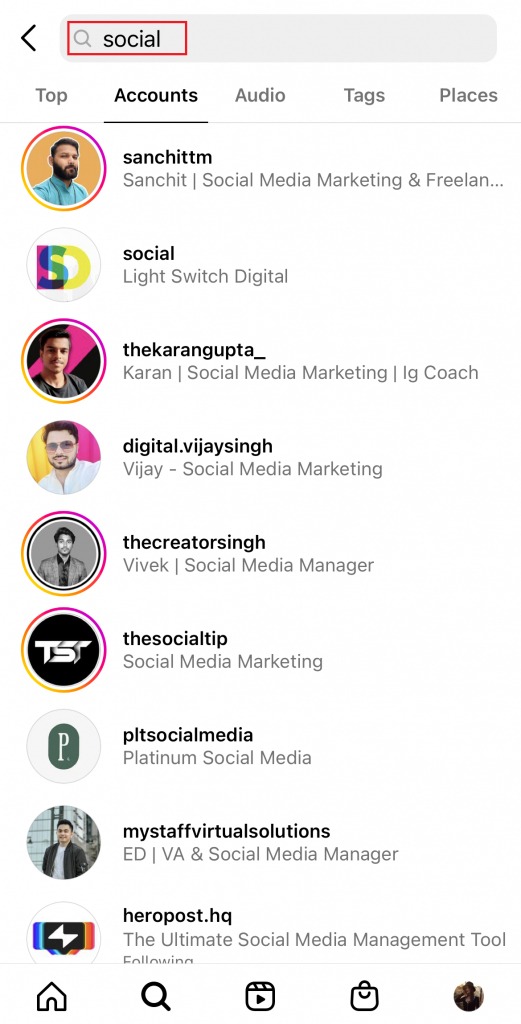

2. Include Job Title

Search bars on social platforms are powerful tools for discovering people, brands, etc. We definitely recommend you add business keywords as qualifiers because people will easily discover you on the search. It is the best way to appear in the search results and make your identity clear. For instance, someone who is looking for a social media manager will probably type “social” first.

These usernames clearly indicate what their professionals are, which makes it easier to connect.

Just like you optimize your website with keywords and SEO, you also need to determine your username doing the same. By using keywords related to your work you’ll identify yourself professionally and build your social media presence. It will ensure that you drive more potential followers.

3. Use Underscores

Adding an underscore at the beginning, end of your username, or in place of spaces is a good option to form your username. Even if your name is not available to use, you can still get it by using underscores.

@vegas_nay (Naomi Giannopoulos)

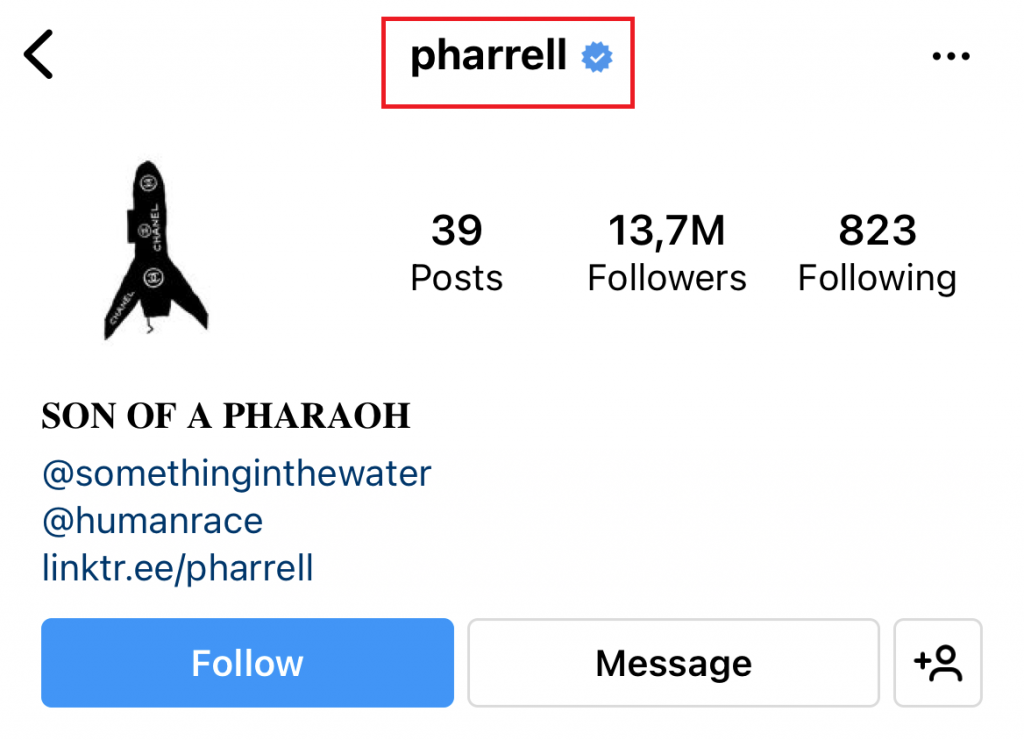

4. Make Your Name Shorter

If your name is not easy to type or looks confusing at first sight, you can shorten your name so that it will look simple and aesthetic.

@pharrell (Pharrell Williams)

@zo (Lonzo Ball)

@aoc (Alexandria Ocasio-Cortez)

@jlo (Jennifer Lopez)

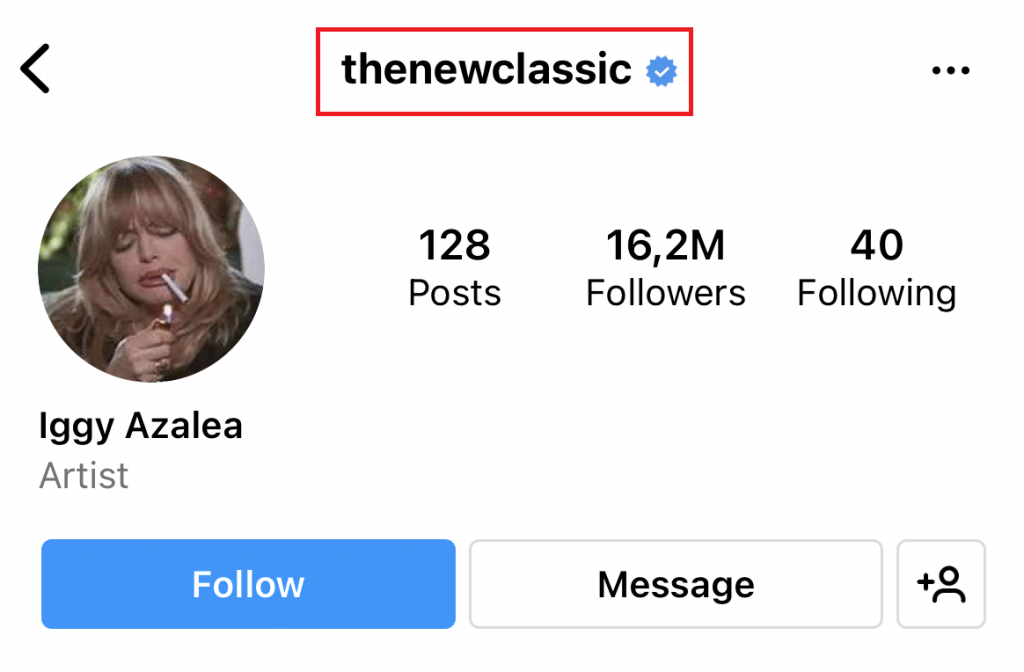

5. Add “the” Before Your Name

Adding “the” before your name trick can be used for both personal and business accounts to keep your name. If your target keywords are already taken, you can try determiner “the”.

@thenewclassic (Iggy Azalea)

6. Use “Official” or “Real” in Front or at the end of Your Name

Add words such as “official” or “real”. It will help you differentiate your profile from others who share the same usernames.

@kadebostany_official

7.Add “I am”, “It’s” or “This is” Before Your Name

Adding these phrases can help when your desired name is not available to use. These three are simple ways to create unique usernames.

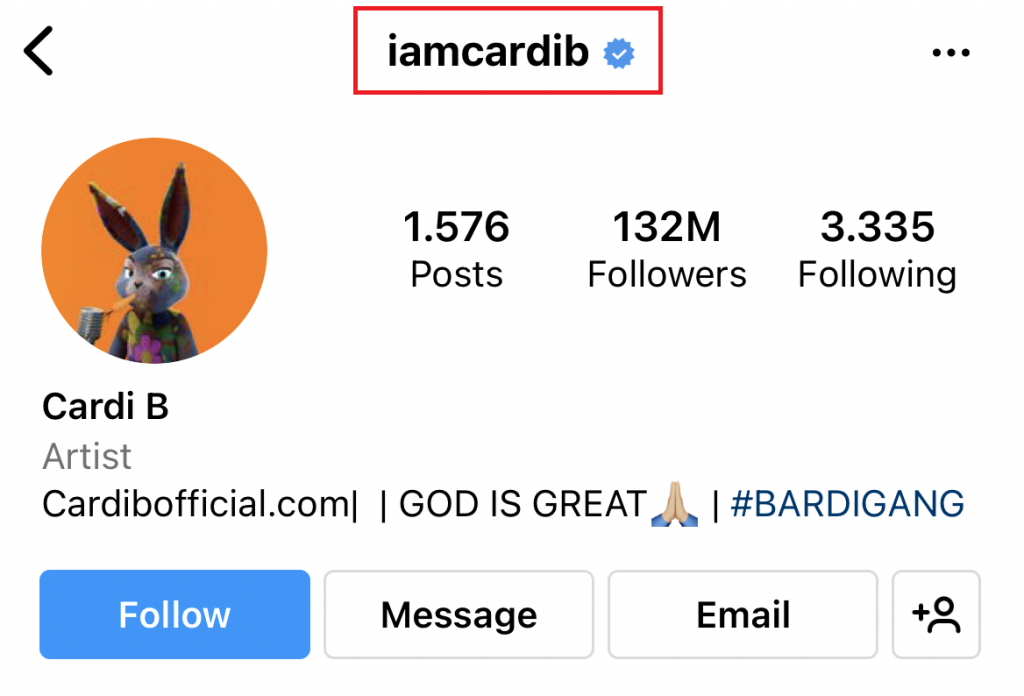

@iamcardib (Cardi B)

@iamdesibanks (Desi Banks)

@iamhalsey (Halsey)

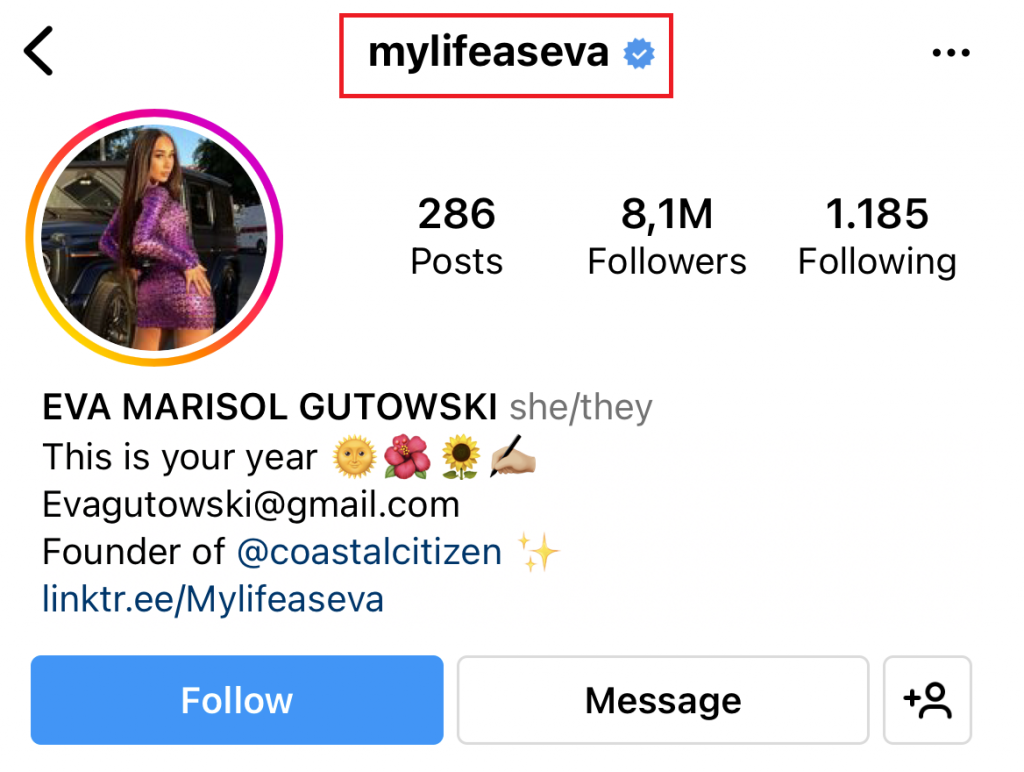

Another way is to determine your own phrase. For instance, you can add “my life as” before your name!

@mylifeaseva (Eva Gutowski)

8. Include a Location

Use your location at the end of your name, which will help you differentiate your account from other similar ones.

@bbcscotland

9. Add Mr, Ms, Mrs, or Miss

These can be added to personal accounts and look very aesthetic.

@missdollycastro (Dolly Castro Chavez)

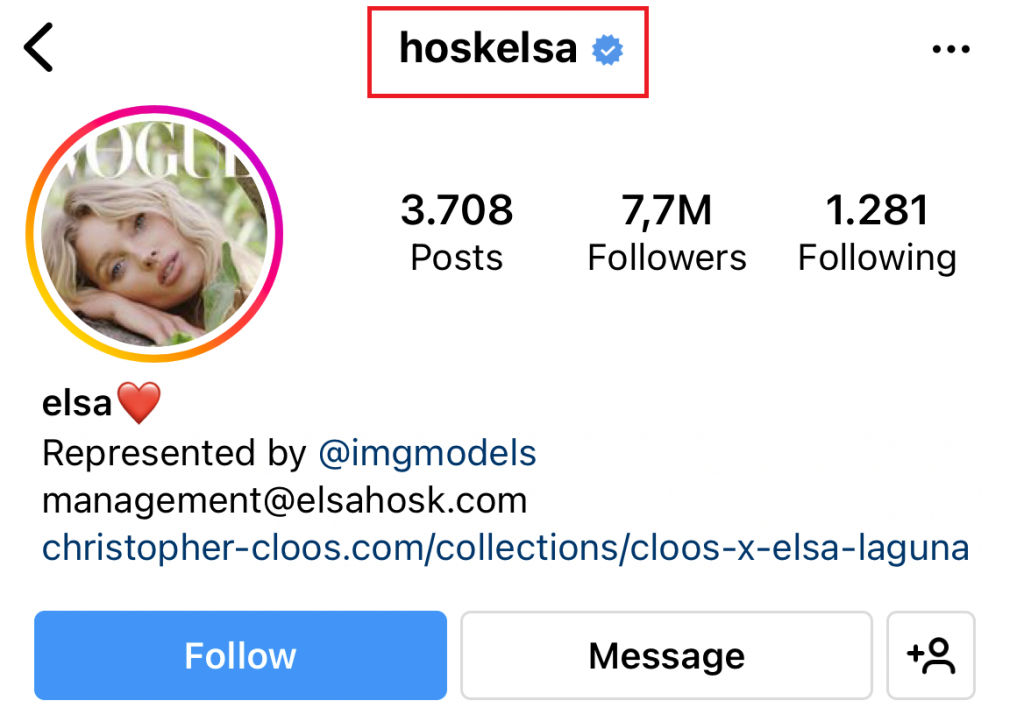

10. Type Your Last Name First

If your name is already taken, then try typing your last name in front of your name. It might even look better.

@hoskelsa (Elsa Hosk)

Create Your Bio

Once you’ve found your ideal username ideas, also optimize your name on your profile. Create your bio carefully. If you’re using Instagram, check out How to Create The Perfect Instagram Bio. Plus, pay attention to 5 Ways to Improve Your Instagram Profile. It will help you grow faster.

In Conclusion

Your username is what represents you on social media platforms. That’s why you need to think carefully and form it the way you need. If you choose it wisely, you can even widen your reach. Username ideas here to help you crate the best one. Be creative and don’t forget to follow the ideas we’ve given!

The post Username Ideas appeared first on Heropost.

Does Instagram Notify When You Screenshot a Story? Instagram screenshot notification is a topic that everyone wonders about. Instagram launched Story feature in 2016. Users can upload an image or a video that lasts 24 hours. The feature allows people to share their daily life scenes, their thoughts, the music they like, etc., which helps everyone to connect with each other freely.

Check out Instagram Story Dimensions to see the guide to creating your Stories in the best way possible!

Also, these Stories can be saved as Highlights on right below bio. Highlights are so popular that people save and classify them by giving titles to Stories of specific moments in their lives. It’s mostly added with Covers on Highlights. Check out How to Add Aesthetic Instagram Highlight Covers if you think your profile looks too simple and needs touch-ups.

Sometimes you may wonder if someone has screenshotted your story or has someone noticed yours. Is it possible on Instagram, just like when you capture a story on Snapchat and the other Snapchatter receive an alert?

Does Instagram Notify When You Screenshot a Story?

No, it absolutely doesn’t notify it currently. There will be no alert or a sign that you screenshot someone’s Story, and you cannot see it if someone screenshot yours, too. You can hide your Story from certain people if you worry about someone screenshotting it without you knowing.

Plus, no one notices when you screenshot anything else on the platform, including posts, reels, captions, etc.

When Does a Screenshot Get Notified on Instagram?

Instagram screenshot notification happens when you screenshot a disappearing photo or video someone sends in your DMs. It sends an alert only if it is a disappearing content in DMs.

Instagram launched Vanish Mood in 2020, which is disappearing mode in DMs. Messages, photos, or videos that are seen disappear when you close the chat. To use it, swipe up in a DM and release your finger. When you switch to the mode, the other person will notify it. If the person you’re texting with uses this mode, there is a warning that says “[User’s name] turned on vanish mode”. Anything screenshotted will be notified in this mode.

The post Does Instagram Notify When You Screenshot a Story appeared first on Heropost.

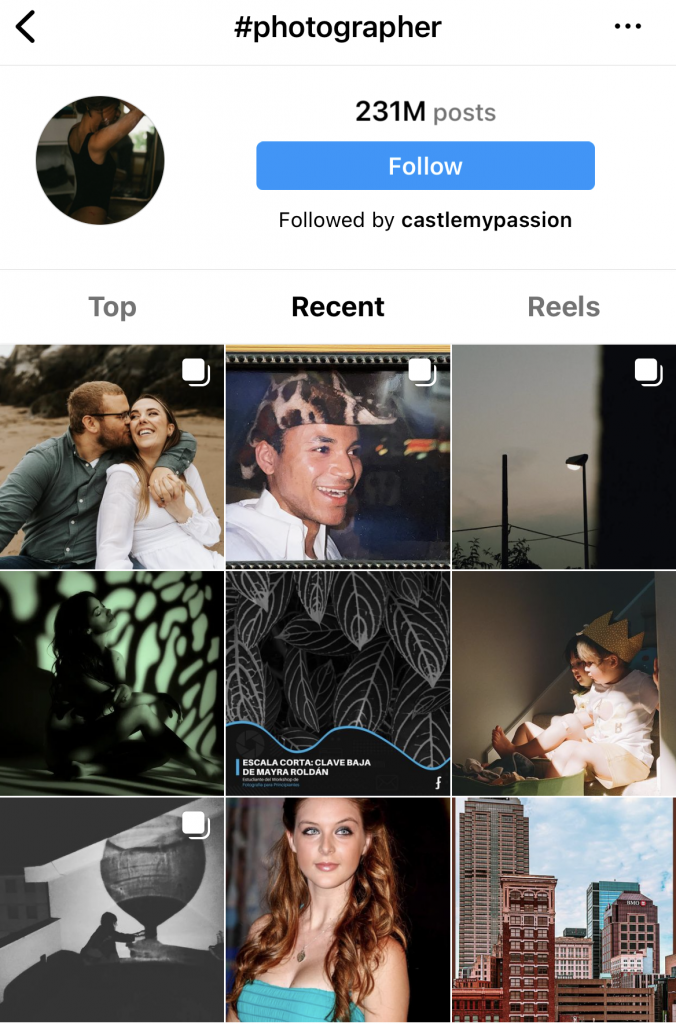

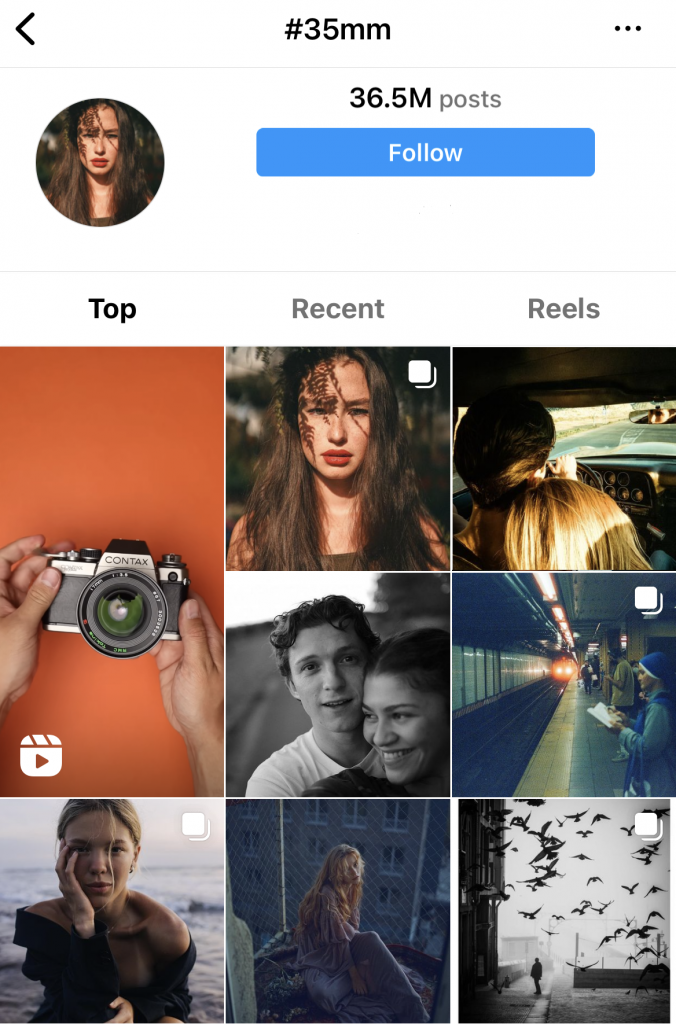

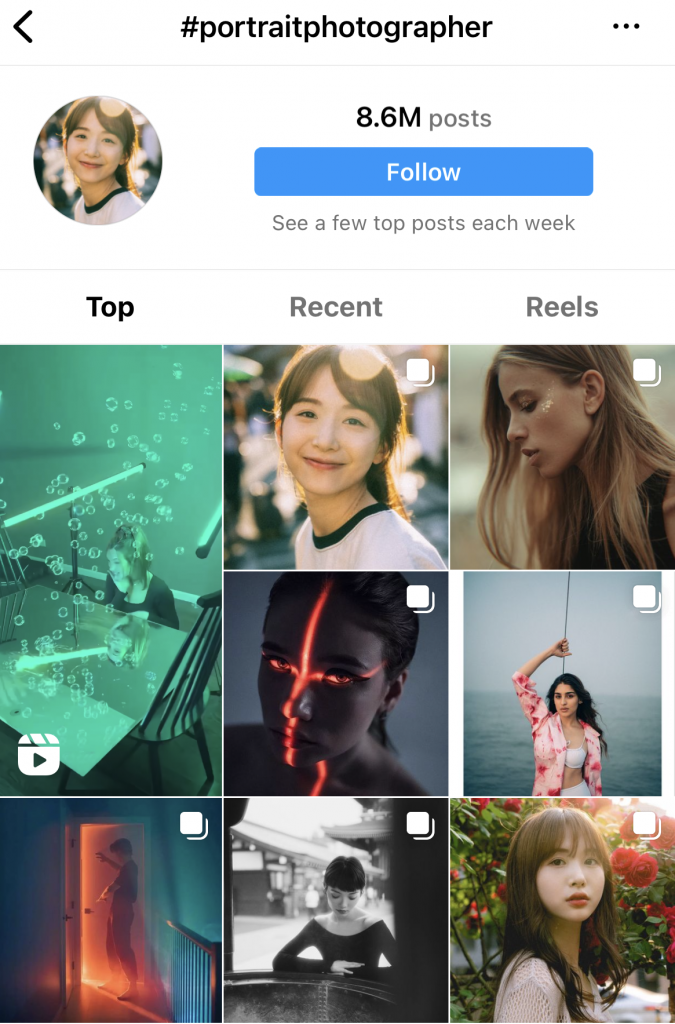

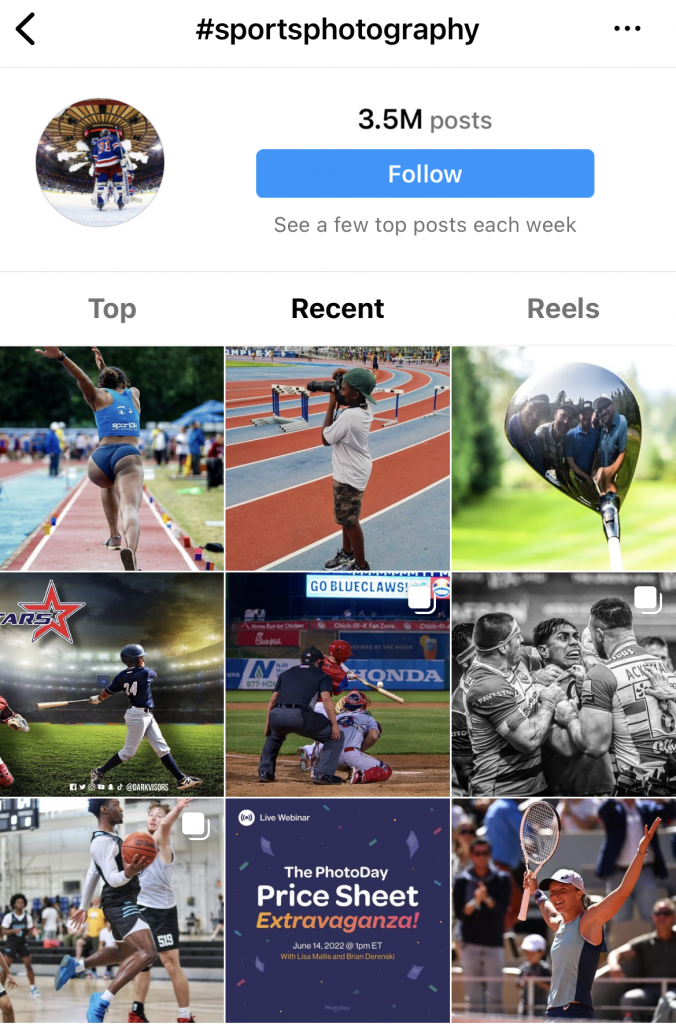

Instagram Hashtags for Photographers

Instagram Hashtags for Photographers are great ways to increase engagement and boost your presence in the photography world. People discover content through hashtags, which helps growth. To receive more shares, likes, and comments, you should add the most popular hashtags to the photo you share. Therefore, you need to utilize niche-specific hashtags that can gain relevant exposure to your posts. In this article, we will help you find the best hashtags for your niche!

Tips for Adding Hashtags

It is possible to add 30 hashtags per photo on Instagram post captions. However, it’s better not to overload your captions with too many hashtags that do not work much with your niche. Instead, you should pick the specific ones that are related to your posts. So, always be careful to type relevant hashtags. Use a combination of common hashtags and niche-specific hashtags to increase viewers as a photographer. If you don’t have time to determine what to type, Instagram Hashtags for Photographers guide is here to help you!

Check out our article about Hashtags to Grow Your Instagram to gain further insight into the world of Hashtagging.

Instagram Hashtags for Photographers

We have listed certain types of popular hashtags below for various photography styles.

You can copy them directly to your post caption. Then, wait for likes, comments, and followings as soon as you share your posts!

General Photography

#photography #photographer #photoshoot #instagood #instadaily #instaphoto #photogram #canon #portraitphotography #photographylovers #photographylover #photographyislife #photographyeveryday #photographysouls #photographyislife #photographylife #photographyart #photographyaddict #yourshotphotographer #fotografia #picoftheday #HDR #HDRspotters #photoshop

Film Photography

#photogram #35mm #35mmfilm #filmcommunity #analogphotography #filmphotography #analogphoto #analogue #ishootfilm #filmcamera #filmfeed #keepfilmalive #filmisnotdead #thefilmcommunity #believeinfilm #shootonfilm #filmphoto #filmforever #analogvibes #analoguepeople #filmphotographer

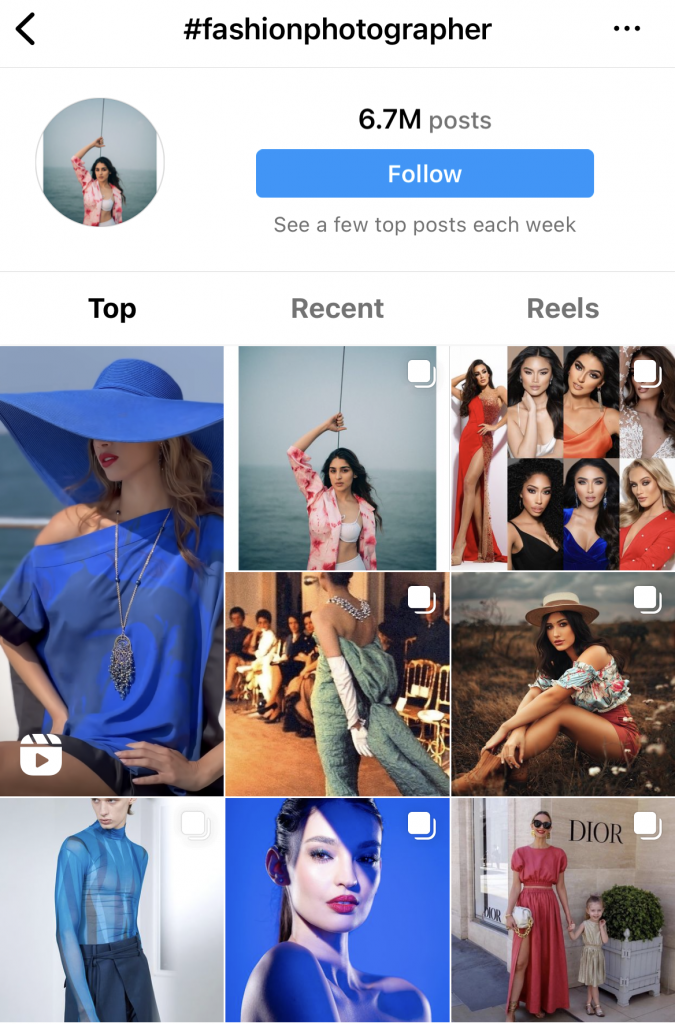

Fashion Photography

#fashion #fashionista #fashionblogger #fashionstyle #fashionphotographer #fashionphotography #fashiongram #fashioninsta #fashionweek #fashionaddict #fashionpost #fashionable #fashiondiaries #fashiondaily #fashionnova #fashioneditorial #fashionmagazine #fashionmodel #fashionshoot #highfashion #instafashion #ootd #fashioninspo #styleoftheday #lookoftheday #styleinspiration #styleblogger

Also, check out 35 Great Instagram Hashtags for Fashion to Increase Engagement.

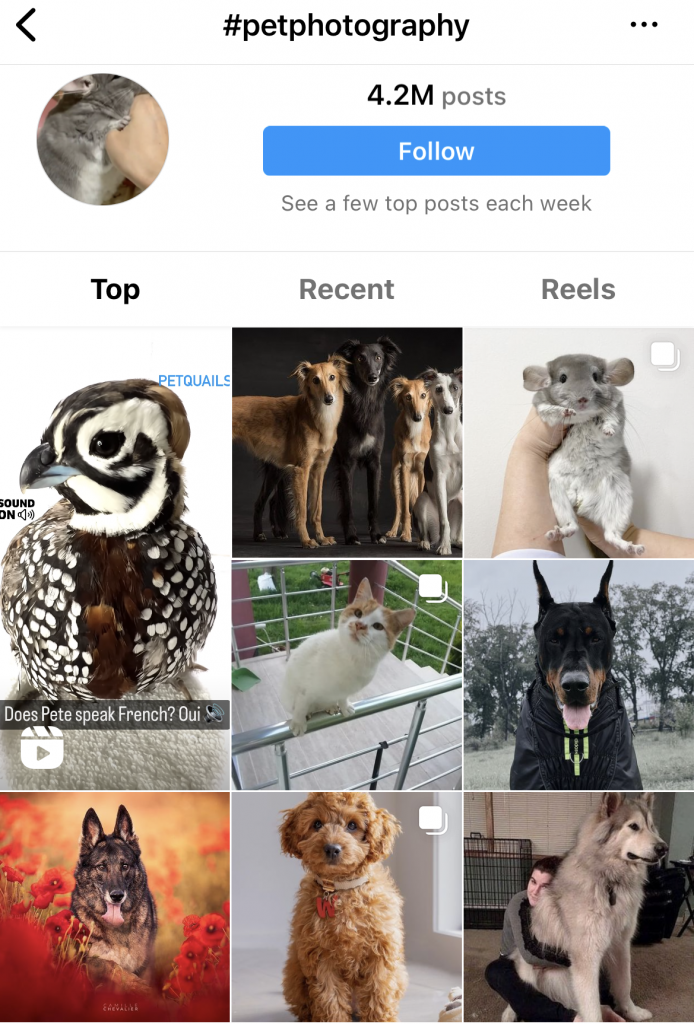

Pet Photography

#animals #pets #petlovers #petsofinstagram #petstagram #catsofinstagram #catlovers #catoftheday #cutecats #catstagram #ilovemycat #catsofworld #dogsofinstagram #dogstagram #instadog #dogsofig #happydog #dogmodel #dogsdaily #instapet #dailyfluff #petoftheday #petphotography #animalplanet #bestwoof #cuteanimals #animalsofinstagram

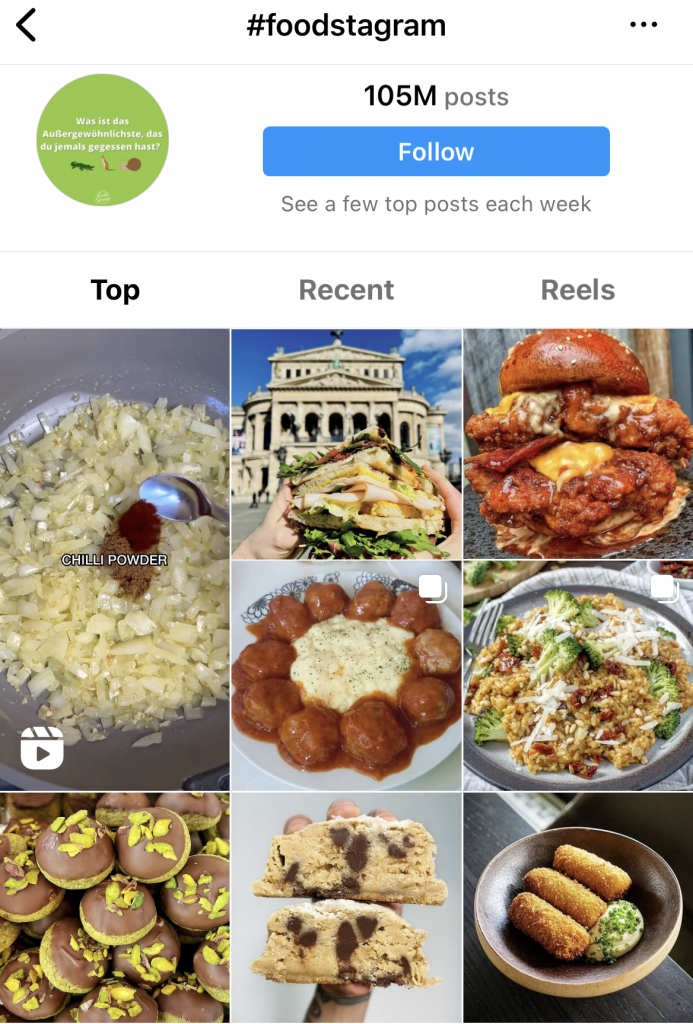

Food Photography

#food #foodie #foodstagram #foodphotography #instafood #delicious #yum #foodgram #foodporn #dinner #lunch #tasty #breakfast #foodpics #gloobyfood #onthetable #yummy #foodblogger #foodpics #foodlovers #gourmet #foodies #f52grams #foodblog #cooking #feedfeed #huffposttaste #gastronomia #foodpic #buzzfeast #foodgawker #beautifulcuisines

Nature Photography

#nature #naturephotography #naturelovers #nature_photo #ignature #ourplanetdaily #naturehippys_ #wildlifephotography #nature_perfection #natureonly #bestcaptureglobal #earthvisuals #visualsofearth #roamtheplanet #discoverearth #wildernessculture #earthfocus #earthpix #natgeoyourshot #allaboutadventures #natureseekers #mountains #plants #flowers #mobilemag #instagood

Sky Photography

#clouds #sky #cloud #skylovers #blueskies #cloudstagram #cloudporn #skyporn #skysnappers #nature #blue #white #sunrise #sunrises #sunset #cityscape #igcentric_nature #light #skylovers #skystyles_gf #ic_skies #iskyhub #cloudy #instahub #iloveclouds #iskygram #beauty #igcentric_nature #natur #tagsta_nature

Travel Photography

#beautifuldestinations #beautifulplaces #travel #explore #travelblogger #hellofrom #travelphoto #travelgram #madetotravel #wonderful_places #traveltheworld #travelscenes #discoverearth #exploretheglobe #getlost #instapassport #sharetravelpics #worldexplorer #justgoshoot #wanderlust #letsgosomewhere #placetovisit #lifeofadventure #travelcommunity

Landscape Photography

#landscapephotography #landscape #landscape_captures #landscapes #landscapelover #landscapeshot #landscape_specialist #earthoutdoors #vibes #nature #letsgosomewhere #beautifulplaces #moodygrams #hellofrom #EarthVisuals #mkexplore #travel #travelgram #madetotravel #wonderful_places #beautifuldestinations #travel #explore #travelblogger #earthfocus #earthofficial #wowplanet #viewpoint

Portrait Photography

#portrait #portraitphotography #portraitmood #portraiture #life_portraits #makeportraits #portrait_perfection #portraits #portraits_ig #portraiture #postthepeople #portraitstream #globe_people #makeportraits #top_portraits #quietthechaos #folkportraits #artofvisuals #justgoshoot #moodygrams #creative portraits

Sports Photography

#sport #sports #sportsphotography #sportphotographer #sportstyle #actionphotography #sportmotivation #active #extremesports #fitness #gohardorgohome #mondaymotivation #sportphoto #workout #gym #fitness #fitnessmodel #keepfit #trainhard

Find and Schedule Hashtags

By using Heropost, you can have a strong selection of 30 reliable Hashtags! Use Heropost Top Hashtags to search for the most popular hashtags within your niche, then schedule your posts by adding hashtags to your caption. You’ll save time by scheduling your posts. Here is a How to Guide for Scheduling Instagram Posts.

By scheduling your content on Heropost, you can plan your Instagram posts in a simple and straightforward way.

The post Instagram Hashtags for Photographers appeared first on Heropost.