A short guide to remote online notarization (RON)

The post A short guide to remote online notarization (RON) appeared first on Blend.

The post A short guide to remote online notarization (RON) appeared first on Blend.

The post <span>KeyBank<span/> and Blend redefine mortgage appeared first on Blend.

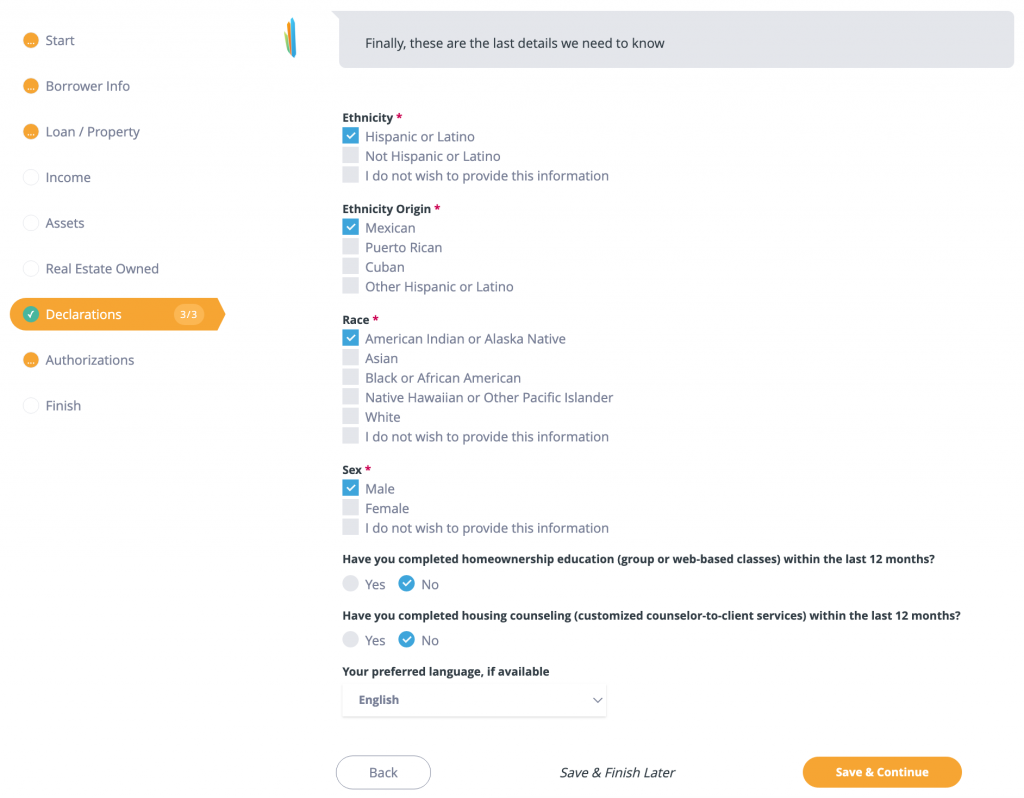

GSEs Fannie Mae and Freddie Mac announced that all new conventional loans will now require a Supplement Consumer Information Form (SCIF). The deadline to remain compliant is March 1, 2023.

The purpose of SCIF is to help lenders collect critical language preference information necessary for the borrower’s homeownership education and housing counseling.

As such, we preemptively updated our Loanzify application to meet the new SCIF requirements.

For additional questions, please contact your Senior Account Executive.

Only a few months after its release, ChatGPT has already changed the way real estate agents do business. This is why it’s made such a big impact and how to make the most of the tool.

ChatGPT is Transforming Real Estate Agent Responsibilities is just one of many great real estate strategies on The Spark

The post Housing Wire Demo Days Purchase Affordability Demo appeared first on Blend.

Artificial intelligence (AI) is delivering real solutions for the mortgage industry. Lenders can leverage these tools to streamline their operations and nurture customer relationships. Here are some of the ways that lenders are using artificial intelligence in the mortgage industry.

The future is already here!

The thought of artificial intelligence might conjure images from a science fiction film. But in real life, artificial intelligence (AI) refers to a computer program designed to perform tasks often associated with human beings.

That’s why AI is linked with automation. AI-powered software can perform many operations with little to no human input. This makes it ideal for managing many back-office business tasks.

It’s no wonder that AI is revolutionizing many industries, including:

AI can improve business efficiency by streamlining core processes. It can also cut down on errors made from manual data entry. In short, AI is changing the landscape of American business.

Even small business owners can use AI to scale their operations without hiring more staff. These benefits make AI great for business owners, including busy mortgage lenders.

How is artificial intelligence shaping the mortgage industry?

AI now powers many types of software. Lenders using a customer relationship management (CRM) platform can experience the benefits of AI in managing the customer pipeline.

Here are just some of the ways that AI is changing the mortgage industry.

AI streamlines the underwriting process from beginning to end. Artificial intelligence can analyze an applicant’s credit history and financial background. As a result, both lenders and borrowers can expect fast, accurate results.

An AI-powered platform may also help analyze applicants with an alternative credit history. Self-employed individuals or recent immigrants may lack the financial documents of traditional borrowers. Artificial intelligence can examine these individuals, building models that accurately predict their creditworthiness.

At the same time, AI can weed out applicants with credit risk. Doing so prevents lenders from extending loans to those who fail to make payments. That’s good news for all borrowers since it lets lenders keep their interest rates competitively low.

Borrowers will also experience the benefits of artificial intelligence in the mortgage industry.

Advanced software can make it easier for borrowers to learn about loan options. Borrowers can even receive real-time feedback from AI-assisted chatbots. The chat feature on a lender’s website can direct visitors to the loan program that fits their goals.

Now that AI powers the prequalification process, borrowers can discover their options in record time.

They also have the capacity to compare rates and terms that have been created just for them. These AI-powered estimates can give applicants a better idea of what to expect. Borrowers may be more willing to use your business rather than turn to your competitors.

Artificial intelligence allows you to create and manage a lead pipeline.

What is a lead pipeline? It’s a system that tracks and guides every step of the customer journey. A well-managed pipeline allows you to nurture relationships and guide customer decisions.

How does AI help? Most lenders are overrun by customer leads. AI can help you filter out “cold” leads, or those who aren’t prepared to make a buying decision. Lenders can focus their attention on leads that are actively looking to buy.

When coupled with mortgage CRM, AI can also provide customer service. AI will send out reminder emails and promotional offers at specific intervals. These automated contacts often nudge applicants to commit to your services.

“Initial here.”

That’s what you’d say if you were assisting your customers in person. But most mortgage companies now rely on paperless forms and e-signatures. These tools enable borrowers to complete applications and upload documents remotely. This speeds up the process since there are fewer visits to your office.

But new borrowers often find themselves in unfamiliar territory. Completing web-based forms can seem a daunting task. How can you help? Artificial intelligence offers prompts to guide borrowers as they complete these documents. It can also provide real-time feedback to reduce errors or missing information.

For lenders, AI also helps manage compliance as you go paperless. You and your team will receive alerts on documents that require a “wet” signature.

Borrowers expect a speedy response to their mortgage applications. But few things slow the process like errors or missing pieces of data.

Using artificial intelligence in the mortgage industry minimizes this risk. AI can pull the information you need directly from the borrower’s financial institutions. Say goodbye to manual data entry.

Both you and the borrower can enjoy a frictionless process. And with less need to go back and make corrections, borrowers can receive a fast response.

Nowadays, more and more of the mortgage process is happening electronically. Data security is more important than ever. AI-powered tools can protect valuable customer data.

Computer-driven processes can analyze data at lightning speed. An AI-driven system can detect anomalies that could pose a cybersecurity threat. You and your team can then take steps to neutralize this threat. Artificial intelligence can provide round-the-clock protection from malware and phishing scams.

AI can also detect fraud. By analyzing application data, AI can flag anomalies that may signal risk. But doesn’t that pose the risk of false positives?

Not with AI. These sophisticated systems can make better decisions about each applicant. Legitimate applicants will be safe, while you experience less stress from fraud.

Many mortgage businesses are small in size. But AI can provide the powerful tools of a major corporation. As a result, you can do more without the cost of hiring more staff.

For example, AI enables higher customer volume. You’ll process more applications by using artificial intelligence in the mortgage industry. Automated communication tools keep clients up-to-date. Mortgage brokers can handle more clients without getting bogged down by administrative tasks.

AI also reduces costs. An AI-powered mortgage CRM, for example, is much more affordable than hiring a new employee. Many lenders discover that the right software can do the work of an entire team.

The savings allow you to grow and expand your business effortlessly. That translates into more revenue. It also allows your community to enjoy affordable real estate services.

Unfortunately, bias persists in the mortgage industry. Even today, mortgage professionals can be vulnerable to unconscious bias. Borrowers may be denied loans based on race, class, or sexual orientation.

Using artificial intelligence in the mortgage industry can sidestep these biases. How? The screening process will focus on borrower data — nothing more, nothing less. An algorithm will drive the final decision. This prevents unconscious or institutional biases from entering the equation.

AI levels the playing field for underserved communities. It also protects real estate companies against accusations of discrimination. Most importantly, it allows you to contribute to a climate of equity and inclusion.

Mortgage brokers and loan officers rely on various digital tools to run their business. Making use of artificial intelligence in the mortgage industry can augment existing processes.

For example, AI-powered software can integrate with a variety of third-party software. This lets you connect your marketing, financial, and other functions to your CRM. You can then manage your entire operation through an easy-to-use portal.

Integrations make life easier. Your team will have a simpler time managing things through a centralized dashboard. And training new hires will be easier than ever.

For many mortgage professionals, content is king. Blog posts, promotional emails, and social media campaigns also demand time and attention. AI makes things faster.

Blog posts will become a snap with AI-powered writing programs. Many AI-powered apps check your work for spelling, grammar, and reading ease. You’ll sound like a professional while creating content that readers can comfortably navigate.

Many mortgage CRMs also contain pre-built marketing templates. You can generate relevant content, then use AI-powered tools to automate your social media calendar. This presents the ultimate “set it and forget it” approach to online marketing.

Any leads you generate will enter your automated pipeline (see above). These features make your business all but self-sustaining.

Put simply, AI lets you do more. To recap, using artificial intelligence can help you:

Lenders who use this technology can also impress other real estate professionals. This allows you to build a referral network that keeps your business thriving.

Want to learn more about the AI-powered tools contained in a mortgage CRM? The BNTouch platform offers features that help with marketing, administration, and more.

The post How Artificial Intelligence Is Revolutionizing the Mortgage Industry appeared first on .

The post Gaining trust in our post-loyalty economy appeared first on Blend.

The post The race to achieve PFI status appeared first on Blend.