Google provides some reasons why it won’t use your HTML title tags; Monday’s daily brief

Search Engine Land’s daily brief features daily insights, news, tips, and essential bits of wisdom for today’s search marketer. If you would like to read this before the rest of the internet does, sign up here to get it delivered to your inbox daily.

Good morning, Marketers, autumn officially starts on Wednesday (if you’re in the northern hemisphere).

But, in my neighborhood, the fall and Halloween decorations started popping up over the weekend, which reminded me that many marketers are in the midst of preparing for the holiday shopping season.

Last Thanksgiving, online sales increased 20% YoY, hitting a record consumer spend of over $5 billion. And, nearly half of those transactions happened on smartphones, which was another record. Though we wished the pandemic would’ve receded by now, it’s still around and consumers may now be even more accustomed to e-commerce or hybrid shopping options.

I haven’t done any of my holiday shopping yet (and I expect many others, as well), so there’s still time to promote your goods and hopefully tap into the most profitable time of year for merchants. If you’re looking for ways to increase the organic visibility of your products, here are a few resources to bookmark and share with your team:

- Holiday shopping SEO: Last-minute tips and techniques for e-commerce sites

- Google announces new deals sections, promotional tools and expanded reporting ahead of the holiday shopping season

- FAQ: All about Google Shopping and Surfaces across Google

George Nguyen,

Editor

Google explains why it made the title change to the search results

For the past few weeks, Google told us it was using the designated HTML title tag 80% of the time. But, on Friday, the company said it is using as-is title tags 87% of the time, a seven-point increase: “Title elements are now used around 87% of the time, rather than around 80% before,” Google wrote.

The company listed the following as common reasons why it won’t use your HTML title tag:

- Empty or half-empty titles (” | Site Name”)

- Obsolete titles (“2020 admissions criteria – University of Awesome”)

- Inaccurate titles (“Giant stuffed animals, teddy bears, polar bears – Site Name”)

- Micro-boilerplate titles (“My so-called amazing TV show,” where the same title is used for multiple pages about different seasons)

The SEO community is still mixed on this: Some are optimistic that Google will improve in this area, while others are asking for an option to opt out. If you noticed changes to your click-through rate from the Google search results, it may be related to these changes. Hopefully, the changes are positive since it is a win-win for Google to provide titles that its searchers want to click on. If not, Google said it will keep making improvements. It’s critical that SEOs continue to provide feedback on the adjustments to the title tag system, as well as any changes that play out in real-time.

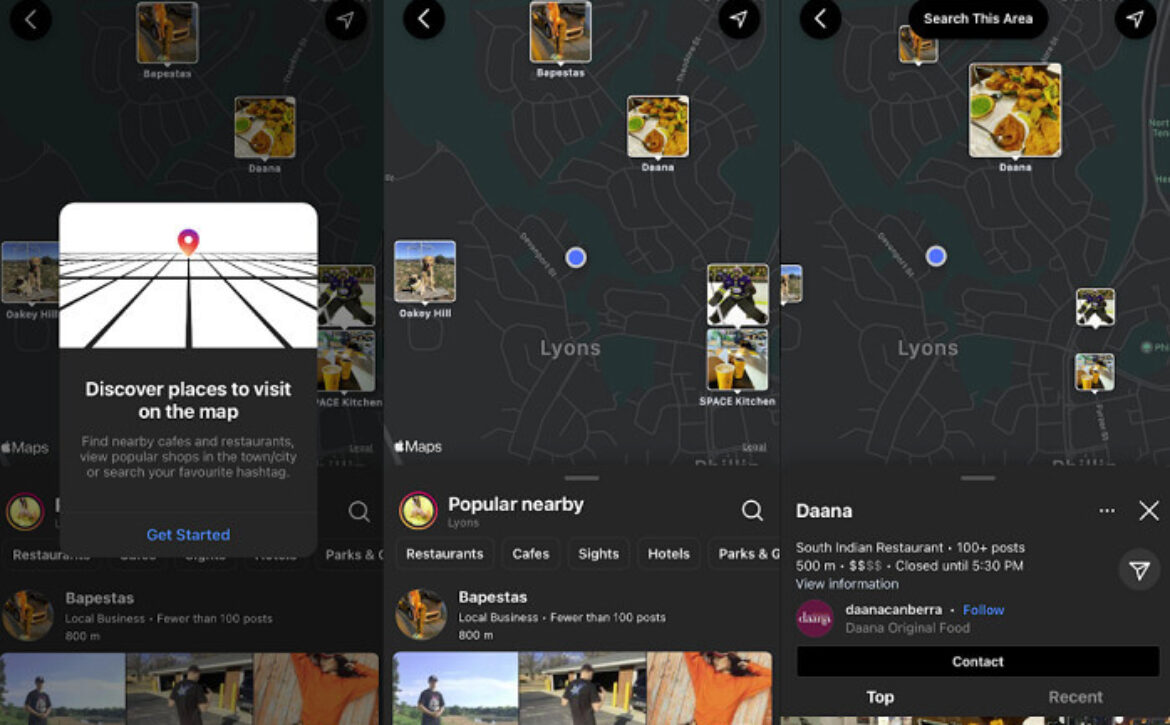

Instagram is testing ‘Map Search’ in Australia and New Zealand

Instagram has launched “Map Search” as a test for its users in Australia and New Zealand, according to SocialMediaToday. This new feature enables users to discover businesses and other locations of interest via the in-app map (shown above), which can be accessed via the map icon in the Discovery tab. Selecting a location on the map shows users a business’ information, public posts tagged at that location and the associated Instagram account for that business (if applicable).

Why we care. If this feature rolls out more widely and hits the right notes with users, it could help local businesses connect with more potential customers, many of which are likely to be nearby and looking for places to visit, shop or dine at. This may also mean that local business owners will have to pay more attention to curating their presence on the platform.

Instagram has steadily added more e-commerce support over the years. One would hope that e-commerce support would be integrated into map listings, offering even more flexibility for local businesses.

Accessibility that won’t ding your SEO, independent reviews mentioned in GMB profiles and considerations for starting your own agency

“I don’t see a problem.” Google’s John Mueller says the search engine doesn’t take issue with hidden text if it’s for accessibility, “partially because the accessibility elements usually aren’t the keywords you’re trying to rank for,” adding that, “If they were the only mention of your main keywords on your pages, that would be trickier.”

“Reviews on independent sites” seen on GMB profiles. There have been more and more reports of GMB profiles that include text like “200+ reviews on independent sites.” Tip of the hat to Joy Hawkins, who first brought this to our attention. We’ve reached out to Google to see if it’s willing to provide any details.

7 things to know before starting a PPC agency. Kirk Williams, owner of ZATO Marketing, shares three reasons why starting an agency in 2022 may be harder than ever, and four reasons why it may be easier than ever.

What We’re Reading: Documents reveal Facebook’s weak response to human traffickers and drug cartels on its platform

“Scores of internal Facebook documents reviewed by The Wall Street Journal show employees raising alarms about how its platforms are used in some developing countries, where its user base is already huge and expanding,” Justin Sheck, Newley Purnell and Jeff Horwitz wrote, “They also show the company’s response, which in many instances is inadequate or nothing at all.”

Facebook employees have flagged human traffickers operating in the Middle East, luring women into abusive employment situations or sex work. In Ethiopia, armed groups used the platform to incite violence against ethnic minorities. The article goes on to discuss organ selling, pornography, cartels recruiting teens to attend hit-man training camps and more.

“The company took down some offending pages, but took only limited action to try to shut down the activity until Apple Inc. threatened to remove Facebook’s products from the App Store unless it cracked down on the practice,” Sheck, Purnell and Horwitz wrote, explaining that Apple’s threat was in response to a BBC story about maids for sale.

Facebook’s attitude on these issues seems to be that it is “simply the cost of doing business” in those regions, according to Brian Boland, a former Facebook vice president in charge of partnerships with internet providers in Africa and Asia. This claim seems to be substantiated by the documents the WSJ reviewed: “In an internal summary about the episode, a Facebook researcher wrote: ‘Was this issue known to Facebook before BBC enquiry and Apple escalation?’ The next paragraph begins: ‘Yes.’”

The article goes on to explain a few reasons why this has been allowed to happen, language being one of them. If anything, these excuses work to highlight the company’s priorities, which apparently don’t include the safety of its users in those regions.

Why we care. Facebook is suffering in more ways than one: Its reputation has taken hit after hit since 2016 and it only seems to have gotten worse with COVID misinformation last year. In January, the company revealed that it actually lost daily active users in the US in Q3 and Q4 last year, despite a pandemic that forced more people online. Average time spent on Facebook by US users has also been on a steady decline (from 41 seconds in 2017 to 37 seconds in 2021), according to eMarketer.

For brands that rely on Facebook, this may mean that your target audience on the platform is shrinking and that there may be fewer opportunities to reach those individuals. This might get worse before it gets better as more users are following their beliefs and refusing to support companies that are complicit with human rights violations. And, I have to imagine that the users in these regions are associating the social media network with such violations, which may hinder its growth abroad.

The post Google provides some reasons why it won’t use your HTML title tags; Monday’s daily brief appeared first on Search Engine Land.